PetroVietnam Insurance Corporation (PVI) was established in 1996 as a captive insurance company for the Vietnam Oil & Gas Corporation currently known as the Vietnam National Oil & Gas Group (PetroVietnam). PVI has developed itself by a significant lead into the forefront industrial insurance company in Vietnam having become the leader in key markets.

. PVI currently holds nearly all of the energy insurance market share; about 30% of marine insurance market share and around 40% of property and engineering insurance market. The company has tirelessly strived to become a regional prestigious Insurance and Finance Group over the past years.

Since its inception with only 20 staff and an initial chartered capital of roughly USD 1 mil, PVI has become after 14 years of development the largest capital invested insurer in Vietnam insurance with total equity and assets being USD 135 mil and USD 338 mil respectively as of the first quarter of 2010. PVI has successfully accomplished its mission of providing insurance services for property risks and business operations of PetroVietnam and has become the second largest insurance company in Vietnam in terms of revenue. PVI has gradually narrowed the gap between itself and Bao Viet, the existing leading non-life insurance company in Vietnam. According to Vietnam’s Ministry of Finance, PVI accounts for 22.6% of the market share with Bao Viet occupying 23.5% of in terms of gross written premium through the first quarter of 2010. These are praiseworthy and remarkable achievements especially given the competitive and crowded local market with 28 non-life insurance companies.

Maintaining and developing its core business of industrial insurance, PVI has established itself as the leading industrial insurance company in Vietnam for a number of years. PVI’s customers include large industrial and service sector groups in Vietnam such as the Posts and Telecommunications Group, Vietnam Electricity Group, Vietnam Shipbuilding Industry Group to name a few, as well as leading international institutions and companies such as Gazprom, Conoco Phillips, Chevron, Nippon Oil, Petronas, Talisman, KNOC etc. Quoting Mr. Nguyen Anh Tuan, PVI’s Chairman, “PVI is proud to be an insurance company being able to sustain the fastest and sustainable growth among leading local insurers while maintaining a strong competitive capability. Our aspiration is to bring about the best benefits to our customers and shareholders. I firmly believe PVI’s brand slogan the “Flame of Trust” will continue to shine splendidly not only in the domestic market but also internationally.”

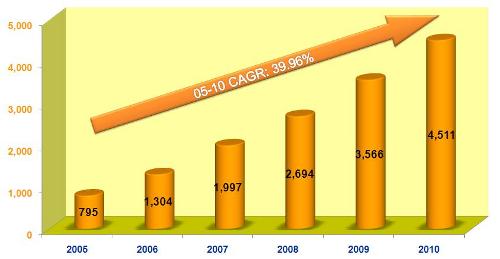

PVI’s performance has been indeed very impressive. PVI has been maintaining the highest growth rate of gross written premiums for the last few years. From 2006 to 2009, PVI’s average growth rate has been 34% meanwhile other key players such as Bao Viet, Bao Minh and PJICO were only able to sustain growth rate of 18%, 10% and 22% respectively (Vietnam Insurance Association, 2009). Meanwhile, PVI has consistently enjoyed loss ratios significantly lower than the average ratio of the market. This further evidences PVI’s risks management capability and professionalism of its sales force. It should also be noted that PVI was one of the first non-life insurance enterprises in Vietnam to successfully develop and apply comprehensive business management software.

Being established initially as a captive insurance company for PetroVietnam, PVI had been given the responsibility to provide insurance coverage for PetroVietnam’s assets, construction works and projects and for PetroVietnam’s projects abroad. Since its foundation, PVI has had the ambition to become one of the leading insurers in Vietnam market and furthermore to develop itself into a leading Insurance – Finance Institution in the region. And for the past 14 years, PVI has kept itself on track to realize these goals. Not only having been locally recognized as the second largest non-life insurer in Vietnam, PVI has been a vanguard of the Vietnam insurance industry while forging a path to integrate itself into the international market. PVI remains a very important partner to giant international reinsurers in Vietnam market regarding reinsurance placement capacity and frequency. This is evidenced in both Facultative and Treaty placement activities. PVI has placed two remarkable international treaties being an Offshore Facility with the Lloyd’s market and an Onshore Facility with leading international reinsurers having limits of liability of USD million 450 and USD 1.54 billion respectively.

PVI is the first and as of the first quarter of 2010 the only company in Vietnam rated by A.M. Best and that is financial strength rating is B+ (Good). This provides a platform for PVI to integrate into international finance-insurance market. At present, PVI is the only local insurer to accept foreign risks including risks in Singapore, Malaysia, Japan and Russia and even in fresh markets such as North Africa, Middle America.

Aiming to become an insurance company with the largest market capitalization in Vietnam, PVI has recently conducted a capital raising effort through which PVI has selected Oman Investment Fund (OIF) as a strategic shareholder with the OIF having acquired a 12.6% stake of the enlarged share capital of PVI. Raising capital and selecting an international financial institution as strategic partner are among strategies to develop PVI into a combined finance-insurance institution. OIF will be involved investment projects taking part in management and control processes of those projects. PVI expects to learn from its strategic partner’s management experience, skills, and high technologies knowledge. As an international experienced investment fund with a worldwide business network, it is hoped that OIF will bring benefits to PVI’s business development. Quoting Mr. Bui Van Thuan, PVI’s CEO regarding this event, “Engaging in strategic partnership with OIF helps facilitate PVI business operations abroad by providing insurance service to Petrovietnam Group’s oil and gas exploration and development activities in Oman as well as enabling further accesses to potential Middle East markets being the world’s capital of natural oil. The successful transaction with OIF reaffirms PVI’s brand-name and helps to bring the Vietnam brand-name in general to the international market”.

PVI will continue its plan of organizational restructuring in accordance with international standards, enhancing competitive capability and strive to be an internationally recognized finance-insurance institution. With the great achievements earned over the last years, PVI is indeed a role model for Vietnam insurance companies.